In transportation, there are four reports that most employers will request when reviewing...

Enterprise organizations rely on vendors to handle critical tasks with greater efficiency and lower cost. Vendors also offer specialized services and expertise that aren’t necessarily in-house. To choose the right third-party partners, you need a strong vendor compliance screening program.

This guide explains why vendor screening matters, what to ask when evaluating potential vendors, and best practices for managing third-party business relationships.

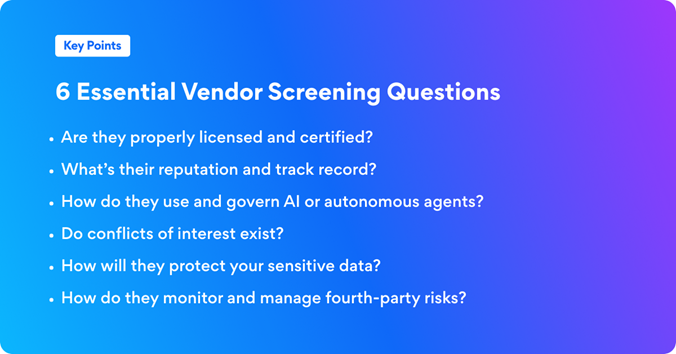

Key TakeawaysHere are the key things you need to know about vendor screening and risk management:

|

|

Vendor screening helps organizations make smart decisions with less risk. Unreliable or unqualified third-party vendors require more active management. They also expose businesses to legal and operational risks, including contract disputes, data breaches, and regulatory noncompliance.

Effective screening includes conducting background checks, verifying references, and reviewing financial data. This process helps you determine whether vendors have the qualifications, experience, security posture, and financial stability to deliver required services. It also helps organizations avoid vendors with histories of poor performance, fraud, or unethical behavior.

Organizations depend on third-party vendors across critical business functions. Each type introduces distinct risk profiles. Business process outsourcing (BPO) providers handle sensitive data through customer service, accounting, and IT operations. Facility management vendors place workers directly on your premises. Recruitment process outsourcing (RPO) firms select candidates on your behalf.

One reason to care about vendor risk is that the legal responsibility for contractor misconduct often extends to the hiring organization.

As attorney Joel Greenwald, managing partner at Greenwald Doherty LLP, recently warned, "Don't lull yourself into a false sense of security that because an individual comes from a staffing agency, you're immune from liability, from being named in a lawsuit."

Background screening vendors require the highest scrutiny because they access your most sensitive data. Look for vendors certified with the Professional Background Screening Association who demonstrate multi-jurisdictional compliance, including adherence to the federal Fair Credit Reporting Act.

The common thread across vendors? Access creates exposure. Effective screening and continuous monitoring protect your organization, regardless of vendor type.

The vendor risk landscape is changing rapidly. Organizations that rely on traditional screening approaches risk exposure to threats that didn't exist two years ago.

Unlike generative AI, which needs human-delivered prompts, agentic AI systems work independently. They make decisions, execute tasks, and adapt strategies without constant oversight. Vendors using autonomous agents introduce new accountability challenges. If an AI agent’s decision leads to a compliance violation or data breach, determining responsibility could become complex.

Security researchers predict the first major public breach tied to agentic AI will occur in 2026. Ask vendors how they govern autonomous AI systems, what guardrails exist, and how they maintain audit trails for AI-initiated actions.

Attackers increasingly target weaker links in extended supply chains through "island hopping." They breach less-secure vendors to access better-defended organizations. Your direct vendors may have strong security, but their suppliers, subcontractors, and cloud service providers might not.

The share of breaches involving third parties doubled from 15% to 30% from 2024 to 2025. Security experts project another doubling in 2026. To add to the risk, when significant vendor spend consolidates to a small number of providers, a single compromise can cascade across your operations.

Vendor screening must extend beyond direct relationships. Require visibility into critical fourth-party dependencies, and assess how vendors monitor their own supply chains. Understanding these risk levels helps businesses make informed decisions about concentration risk and cascade failures.

Deepfake technology has evolved from a novelty to a primary attack vector. Synthesized audio and video now enable attackers to impersonate executives, approve fraudulent transactions, and bypass authentication controls with alarming effectiveness.

By 2026, synthetic media is expected to become the dominant social engineering method for high-value access. Vendor screening must evaluate how organizations detect and respond to deepfake attempts, especially for vendors with access to financial systems or sensitive data.

Annual vendor reviews provide increasingly limited value. Instead, turn to autonomous risk assessment systems, which enable continuous monitoring, real-time compliance validation, and instant adaptation to emerging threats.

Organizations still using periodic questionnaires and manual reviews face growing blind spots. The shift from static annual assessments to dynamic, always-on vendor monitoring is no longer optional.

Beyond emerging threats, fundamental vendor risks remain persistent concerns that require structured mitigation strategies.

All companies must meet applicable laws and regulations. This is especially true for highly regulated industries like healthcare, finance, and transportation. When vendors aren’t in compliance, lack proper credentials, or don’t follow ethical standards, they expose your organization to risk and liability, including fines, criminal penalties, and reputation loss.

For healthcare organizations, vendor compliance is critical. As Heather Badjar, director of onboarding and client success at Cisive PreCheck, explained, "A lot of our clients send over their vendors for us to check so that they can ensure that an outside vendor isn't excluded."

Organizations must verify that vendors and their employees aren't on Office of the Inspector General (OIG) exclusion lists or subject to sanctions that would jeopardize Medicare and Medicaid participation.

Across sectors, and especially in regulated industries, companies should vet vendors for regulatory understanding and compliance before entering partnerships.

Vendors with weak cybersecurity practices can expose your organization to breaches and regulatory violations. Poor data protection includes failure to secure networks, weak encryption and multi-factor authentication practices, and insufficient employee training on data handling.

Data leaks represent the most common third-party risk. According to a recent report, 98% of companies work with at least one third-party vendor that experienced a data breach within the past two years. The average data breach costs $4.45 million, a figure that increased 15% over three years, IBM reports.

Poor vendor performance damages your reputation. Missed deadlines, poor service, or quality failures hurt your brand. When vendors fail to deliver, customers blame your organization. In some cases, negative vendor experiences become public, exacerbating the reputational risk.

Vendors should increase efficiency, not disrupt your operations. Yet 84% of enterprise risk committee members rank operational disruptions as the most common outcome of third-party risk management failures.

Vendors without sufficient resources or expertise might deliver subpar performance or fail to deliver on obligations, creating extra work for your teams. Vendors with weak security, meanwhile, expose you to breaches that disrupt operations and compromise business continuity.

Effective vendor screening is the result of direct vendor questioning, a review of their reputation and track record, and partnering with a background screening expert.

The following six questions should guide your vendor screening checklist:

High-quality vendors maintain proper licensing and certifications for the services you need. Request evidence of credentials for the organization and key employees. This protects your organization from the legal and financial risks of working with unlicensed or noncompliant vendors.

A vendor's public reputation shows their quality of work, communication practices, and reliability. Third-party review sites, industry references, and peer feedback help you understand how vendors handle challenges and customer complaints. Look beyond marketing materials to find patterns in vendor performance and accountability.

A must-ask question in 2026 is asking vendors how they use AI or agentic AI in their products or services. If they do use AI, find out how they govern these systems, whether they train models using customer data, how they safeguard data, and how they maintain transparency in automated decision-making. Vendors who can't or won't answer these questions present unacceptable risk.

Uncover conflicts early so you can make informed decisions about whether they prevent a working relationship. A notable conflict of interest would be existing vendor relationships with your competitors. Others include financial ties to your organization and existing relationships with suppliers or customers that could affect their ability to provide unbiased service. Understanding these connections enables smart decisions about risk.

Assess whether vendors understand and implement security best practices. Asking this question helps identify weaknesses in vendor security systems, encryption protocols, access controls, and employee training. Verify that vendors hold relevant certifications and examine their history with cyberattacks or data breaches. Given the cost of data breaches, inadequate vendor security represents a material financial risk.

Your direct vendor's security is only part of the equation. Ask how vendors assess and monitor subcontractors, supply chains, and cloud service providers. Vendors should demonstrate visibility into critical dependencies and active management of downstream risks that could cascade to your organization.

Effective vendor risk management requires continuous evolution that goes beyond the initial contract. Organizations relying on outdated approaches face expanding blind spots as threats accelerate.

A comprehensive vendor risk assessment evaluates threats posed by third-party relationships and their potential impact on operations, data security, and regulatory compliance. Effective assessments examine vendor policies, procedures, security controls, and compliance certifications. They also identify vulnerabilities and assess financial stability.

Instead of annual snapshots, modern risk assessments increasingly use automated tools for continuous evaluation, enabling organizations to identify and address risks as they emerge.

Traditional vendor due diligence focuses on pre-contract screening, but risk management should continue throughout the vendor lifecycle. Adopt automated processes that ensure regular reviews, including security audits, compliance verification, and performance assessments.

Embrace real-time monitoring systems instead of manual quarterly reviews, giving you instant visibility into vendor security postures, compliance status, and operational health. Continuous oversight enables rapid response when vendor risk profiles change.

Vendor contracts should specify services, performance expectations, security requirements, and compliance obligations. Include provisions for AI governance that account for autonomous systems, transparency requirements, audit rights, and accountability frameworks.

Contracts should also address dispute resolution, liability, warranties, and termination conditions. Clear documentation prevents ambiguity and establishes enforceable standards.

Effective vendor risk management balances oversight with partnership. Maintain open communication to ensure vendors understand your requirements, risk tolerance, and compliance expectations. Share threat intelligence when appropriate and collaborate on security improvements.

However, the spirit of partnership doesn't mean lowering your standards. Hold vendors accountable to contractual obligations while recognizing that constructive relationships enable better outcomes than adversarial ones.

Vendors can be a powerful asset for your company, but partnering with unqualified or unreliable vendors can have far-reaching consequences that affect your bottom line, reputation, and even your ability to be a going concern.

A trusted background screening partner can streamline the process of verifying third-party credentials and vetting vendors for key risks. By leveraging Cisive's vendor screening expertise and resources, you can create a more robust and reliable vendor selection process in an ever-evolving business landscape.

Schedule a meeting with one of our vendor screening experts to discover how to manage risks and hold your vendor partners to the highest standard.

Author: Jenni Gallaway

Bio: Content Marketing Manager at Cisive. 8 years of experience in the background screening industry.

Let's Connect on LinkedIn

In transportation, there are four reports that most employers will request when reviewing...

What are reference checks? Reference checking is the process of a potential employer contacting the...

In transportation, there are four reports that most employers will request when reviewing...